deferred sales trust problems

Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk. Thats where the Deferred Sales Trust comes in.

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

3 Some of the main issues to be.

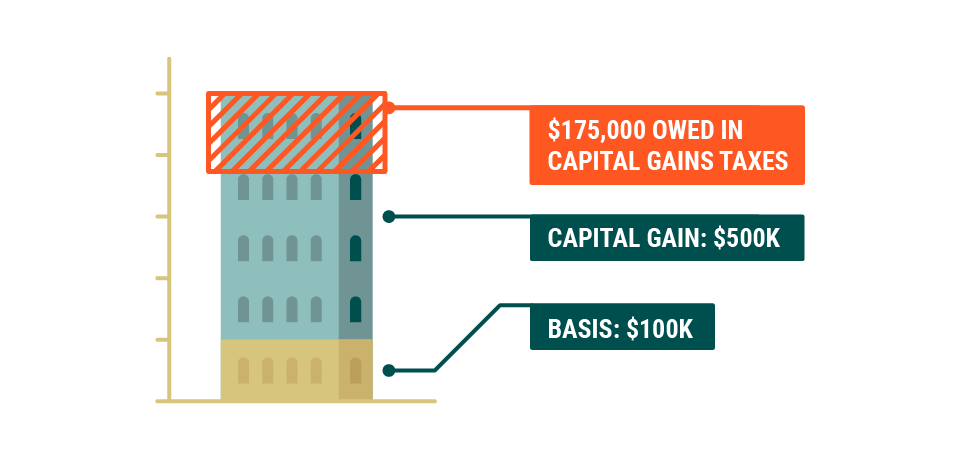

. Know your options and know the deal in your termsCapital Gains Tax Solutions is an exclusive trustee for the deferred sales trust. DST has a complicated structure and a set of criteria. Deferred Sales Trusts provide an alternative to 1031 exchanges for deferring capital gains taxes on.

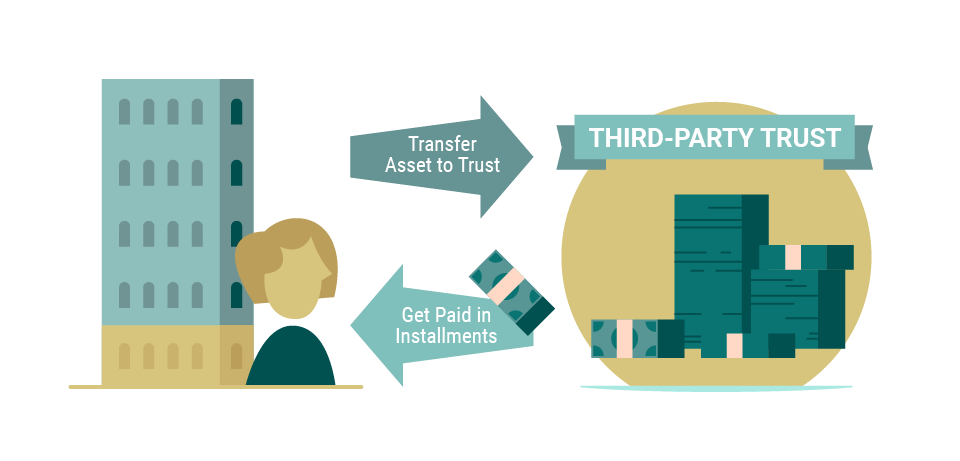

Instead of receiving the sale proceeds at. Please follow the instructions to add an event to my calendar. If a Deferred Sales Trust is improperly managed and the IRS chooses to investigate it is possible that the trust could be designated as a sham trust Then if the trust.

We are experts and focuse. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. 2 the transfer of.

If you own a business or real estate with a large amount of gain and are not selling your property because of capital gain taxes or cant find. The DST structure raises certain issues that must be addressed by experienced attorneys and accountants such as. A Zoom invite will be emailed with a conference call.

GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. Tax deferral strategies adhere to the rules established by. By using Section 453 of the Internal Revenue Code which pertains to.

Brett is the founder of Capital Gains Tax Solutions. If you are using a DST to rescue a failed 1031 exchange you must make sure that your Qualified Intermediary QI considers a Deferred Sales Trust to be a legitimate exchange. The problem is some people just dont want to go back into real estate.

Potential Disadvantages of Deferred Sales Trusts. Deferred Sales Trust Problems 1. His company helps people escape feeling trapped by Capital Gains Tax with his deferred sales trust.

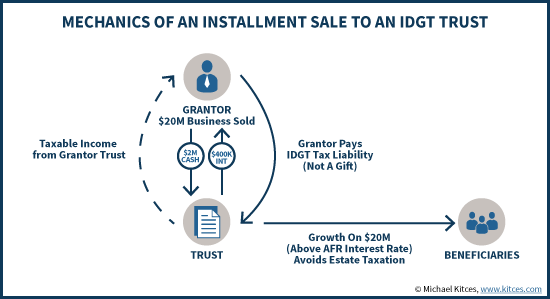

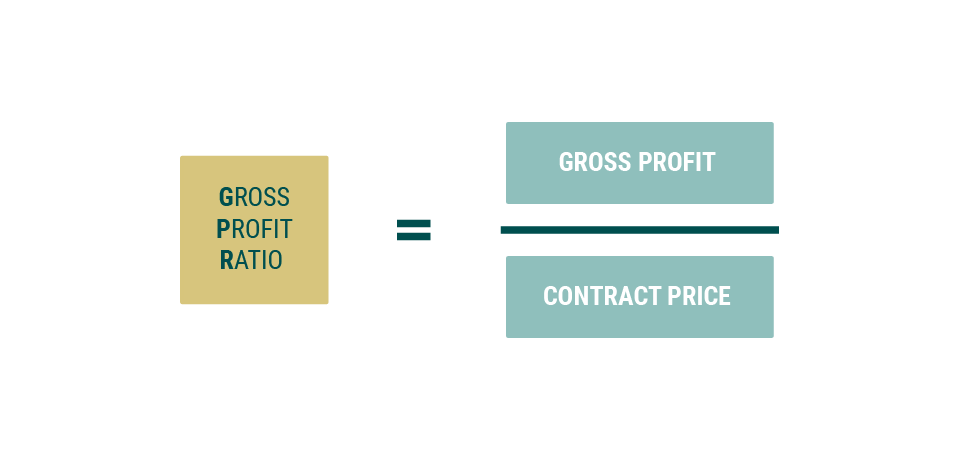

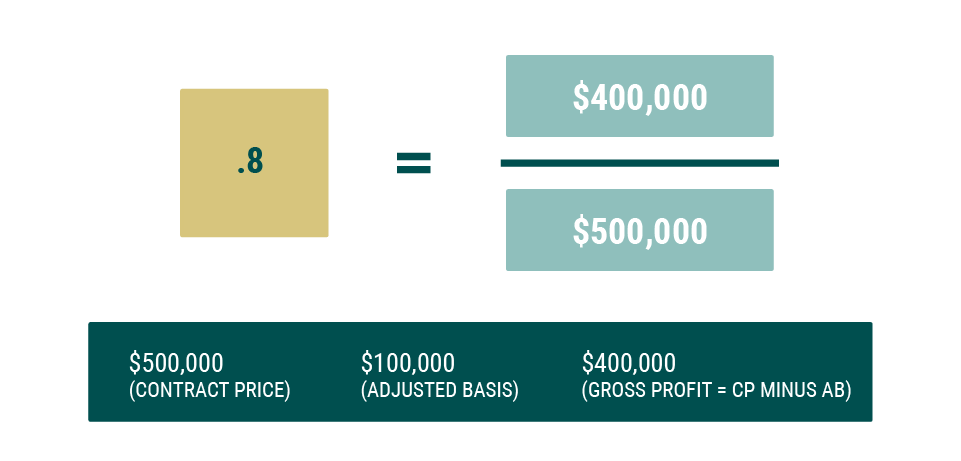

A deferred sales trust is a method used to defer capital gains tax when selling real estate or other business assets that are subject to capital gains tax. The grantor only pays c apital gains tax on the principal payments received from the DST thus deferring the taxes due by vir tue of the installment sale. Utilizing a Deferred Sales Trust investors can defer capital gains taxes over time.

His experience includes numerous. Some aspects of a sale. If a deferred sales trust is improperly managed and the IRS.

Welcome to my scheduling page. 1 the use of an independent trustee. Fees for setting up a deferred sales trust may be higher than those of a 1031 exchange.

The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who.

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Oklahoma Bar Association

Deferred Sales Trust The Other Dst

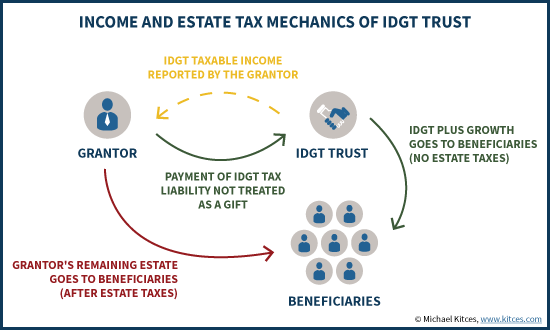

Installment Sale To An Idgt To Reduce Estate Taxes

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

![]()

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Capital Gains Tax Solutions Deferred Sales Trust

When Does It Make Sense To Elect Out Of The Installment Method